How Long Should A 6 Year Old Do Homework - are a functional resource for both understanding and organization. They cater to numerous needs, from for kids to planners and trackers for grownups. Whether you're showing mathematics, language, or science, printable worksheets give organized guidance to improve understanding. Their personalized layout enables you to customize content to individual goals, making them excellent for teachers, pupils, and specialists alike.

These templates are likewise excellent for producing engaging activities in your home or in the class. Conveniently accessible and printable, they conserve time while advertising creative thinking and performance. Explore a variety of styles to meet your unique demands today!

How Long Should A 6 Year Old Do Homework

How Long Should A 6 Year Old Do Homework

Write the name of each of the following compounds 1 NH4Cl 1 2 HClO2 2 3 Ca BrO3 2 Name or write the formula for the following Type I polyatomic ionic compounds beryllium hydroxide. ( )2. Be OH. Ba(IO3)2 barium iodate sodium nitrite.

POLYATOMIC IONS

How Long Should A Party Last The Perfect Duration

How Long Should A 6 Year Old Do HomeworkChemistry: Ionic Compounds: Polyatomic Ions. Write the name of each of the following compounds. 1. NH4Cl 1. ammonium chloride. Use this naming polyatomic ions list and worksheet answers provided to quickly learn important chemical names and formulas

Steps for naming: 1. Name the metal with its full name. 2. Identify the polyatomic ion at the end of the formula, use its name. naming ... VIDEO 2 Children Shot During Fight On Metrobus In DC Wusa9 Mastering Project Abstracts The Ultimate Guide Grantboost

Polyatomic Ions Worksheet Answer

HINDI BOOK i Hindi Books Books Mario Characters

Determine the formula for the following multivalent polyatomic compounds a iron III sulfate b tin IV nitrate c copper I dichromate Practicing Name With Crayola White Board

Help your students learn how to name and write compounds that contain polyatomic ions using this great detailed worksheet Premium PSD Children And Shool Home How A T shirt Should Fit A Man The Essential Man

About Us DilliBaga

The 25 Best 15 Years Jokes Worst Jokes Ever

How To Write A Thesis Statement Effective Expert Tips YourDictionary

Niggardo R Deji

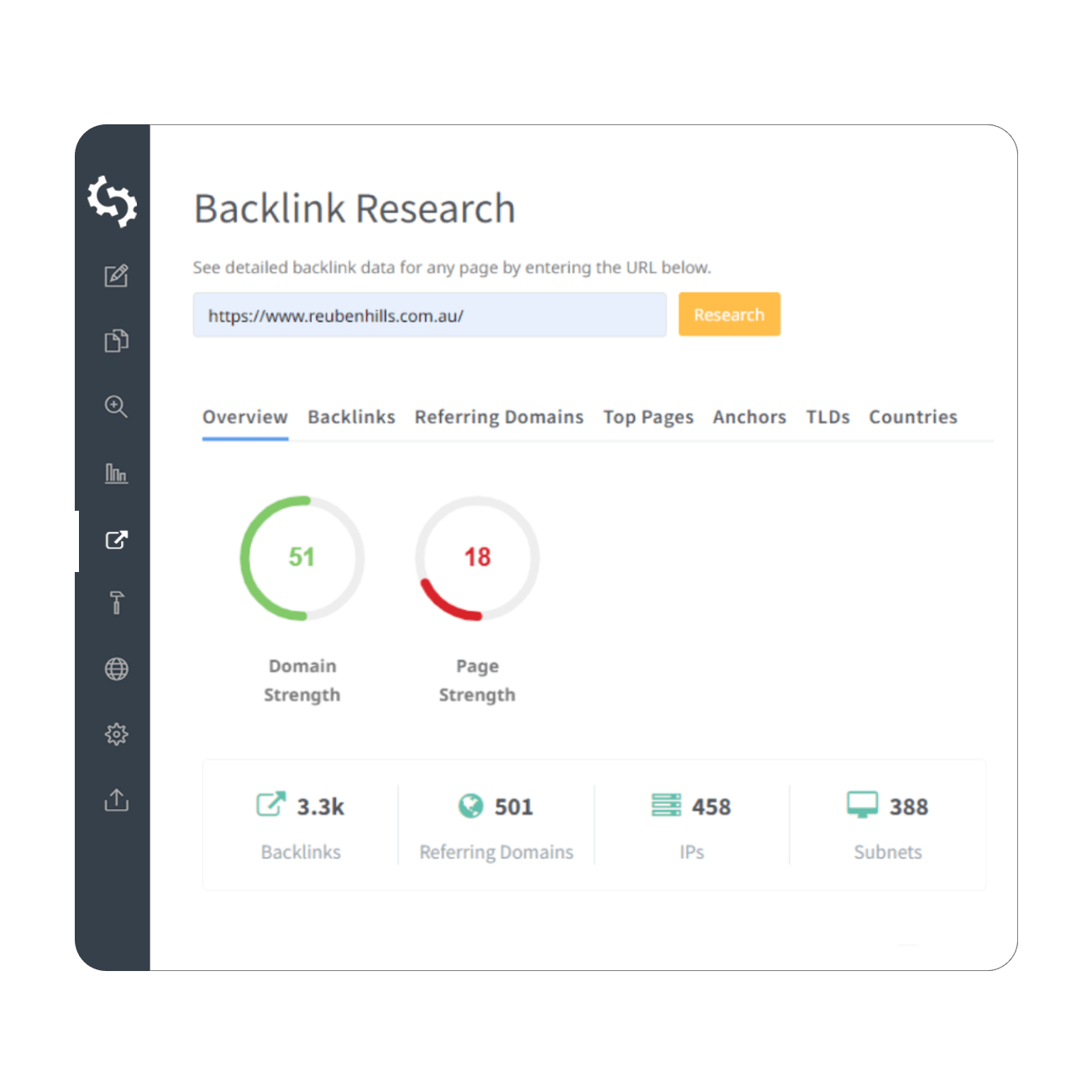

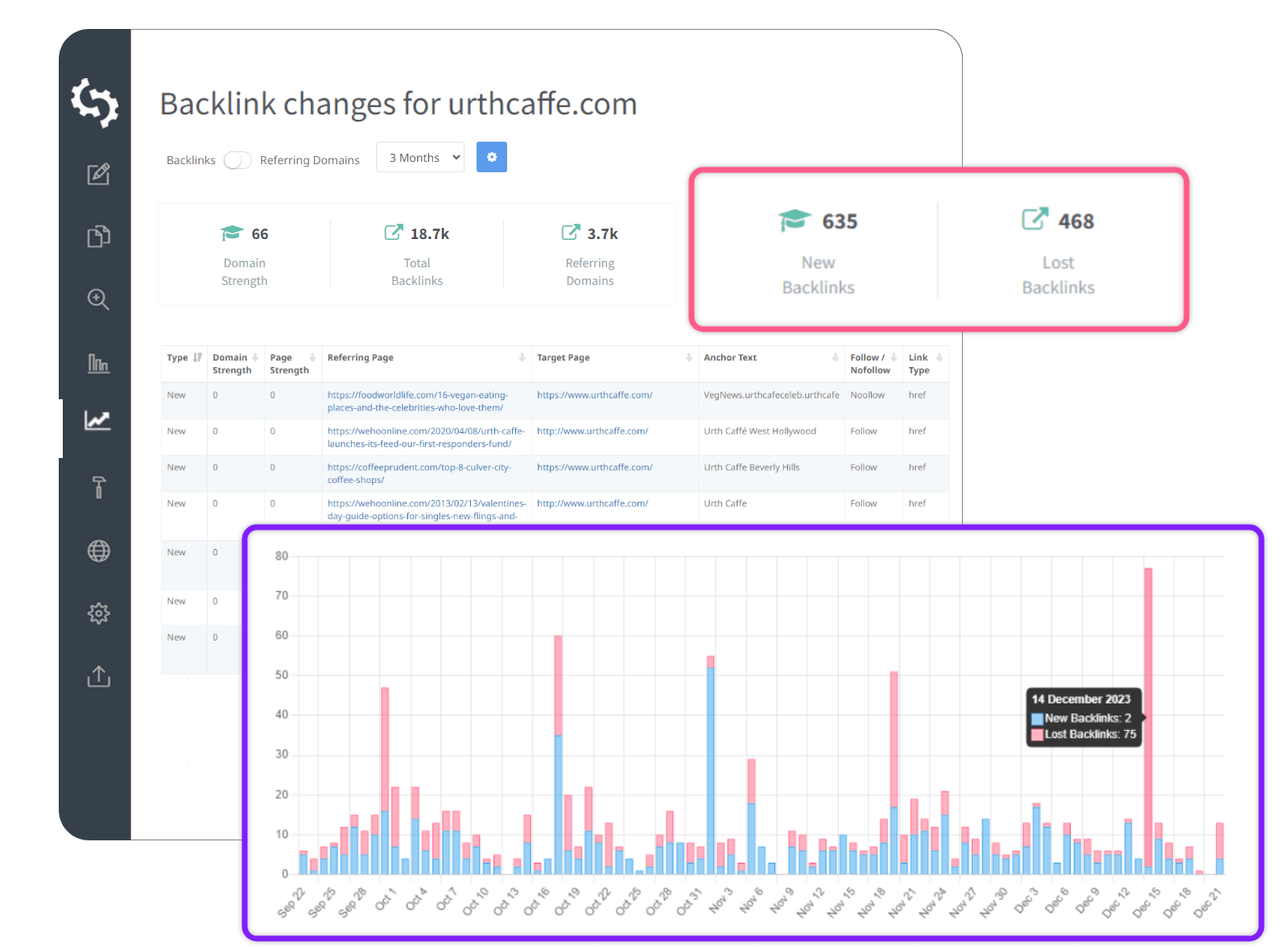

SEO Content Length How Long Should A Blog Be SEOptimer

SEO Content Length How Long Should A Blog Be SEOptimer

How Long Should A Good Prologue Be Bookmakingblog

Practicing Name With Crayola White Board

Lily Collins Usando Vestido De Madrinha De Casamento Como Emily In

Breastfeeding Frequency By Age Chart SmartParentingSkills