Ten Frame Subtraction Worksheets Free Printables - are a flexible resource for both learning and organization. They satisfy various demands, from for youngsters to planners and trackers for grownups. Whether you're educating mathematics, language, or science, printable worksheets provide organized assistance to boost understanding. Their personalized style permits you to tailor content to private goals, making them optimal for teachers, students, and experts alike.

These templates are additionally excellent for producing engaging tasks in the house or in the class. Quickly easily accessible and printable, they save time while advertising creativity and performance. Explore a variety of designs to satisfy your unique demands today!

Ten Frame Subtraction Worksheets Free Printables

Ten Frame Subtraction Worksheets Free Printables

Solving Two Step Equations SOL 7 14 Example 1 Solve the two step equation Check your 7 p 3 35 48 6 v 2 3 2 5 4 These Algebra 1 Equations Worksheets will produce problems for solving proportions using polynomials and monomials. ... 7th Grade through the 9th Grade. One Step ...

Solving Equations Worksheet Glow Blogs

Ten Frames Worksheets

Ten Frame Subtraction Worksheets Free PrintablesA moderate practice awaits 7th grade and 8th grade students here! Solve a series of one-step equations with their terms incorporating fractions as well as mixed ... Free Math 7 Worksheets Review multiplication one step equtions Then cross multiply to solve for the variable Solve for the variable in one step problems

Two-Step Equations. Solve each equation. 1) 6 = a. 4. + 2. 2) −6 + x. 4. = −5. 3) 9x − 7 = −7 ... Worksheet by Kuta Software LLC. 13) −15 = −4m + ... Two-Step ... [img_title-17] [img_title-16]

Algebra 1 Worksheets Equations Worksheets Math Aids Com

Ten Frame Worksheet Subtraction 1 To 20 Using Ten Frames

This is a comprehensive collection of free printable math worksheets for grade 7 and for pre algebra organized by topics such as expressions integers [img_title-11]

Browse solving equations 7th grade resources on Teachers Pay Teachers a marketplace trusted by millions of teachers for original [img_title-12] [img_title-13]

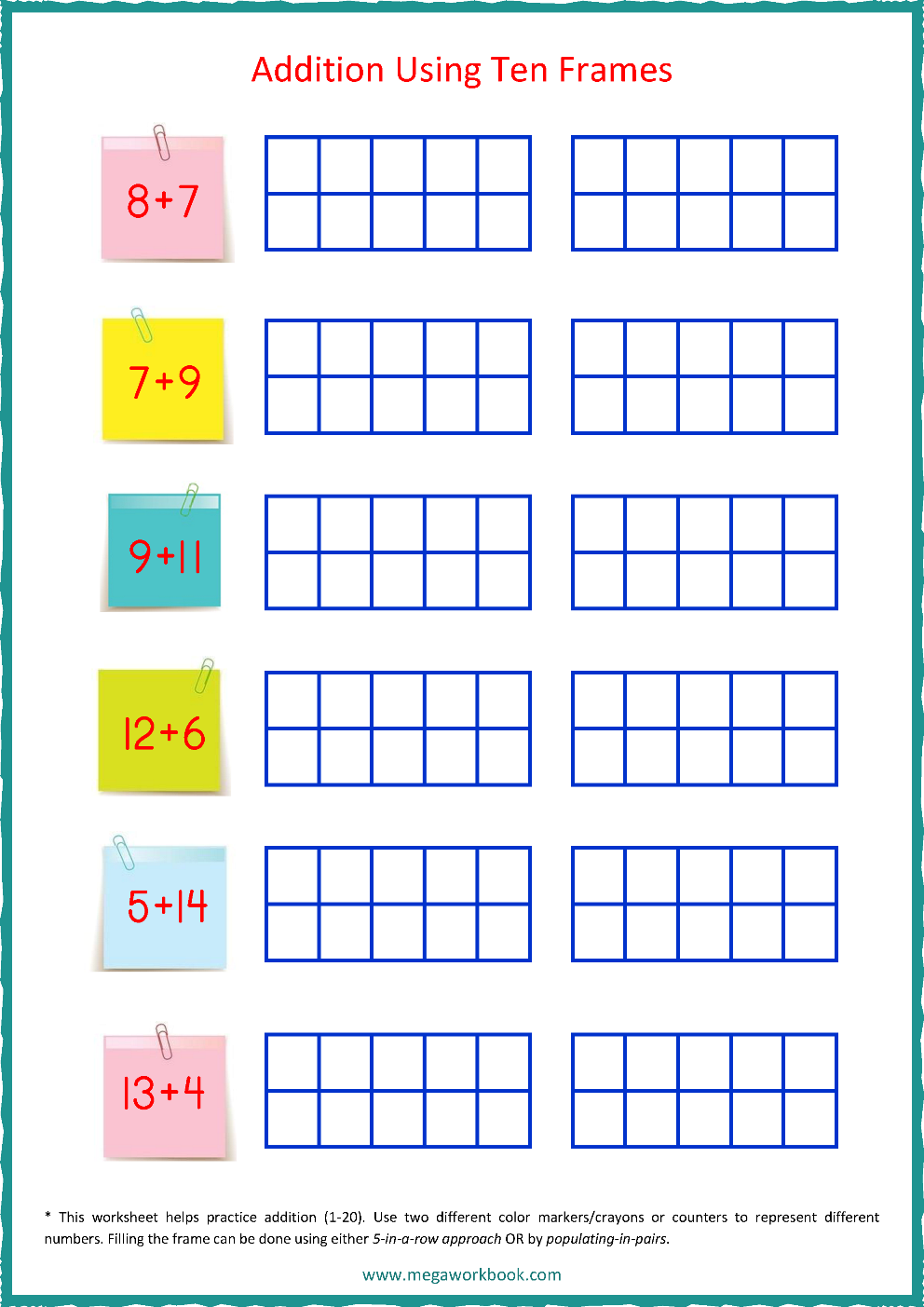

Ten Frame Worksheets Ten Frames 10 Frames Counting Addition

Ten Frame Worksheets Ten Frames 10 Frames Counting Addition

Printable Tens Frames

Ten Frame Worksheet Subtraction 1 To 20 Using Ten Frames

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]